Podcast: Play in new window | Download

Subscribe To Our Podcast

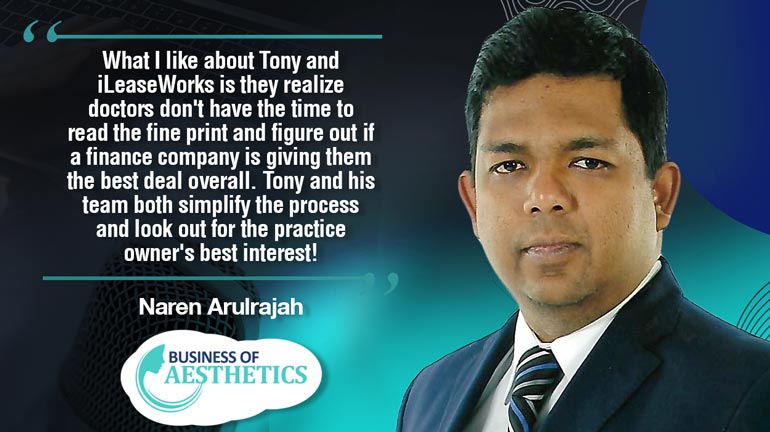

Proper financing often is the elixir that brings success to your practice and it also has a close relationship to acquiring physical resources that assure a smooth run for your practice. Listen to this week’s episode where Tony Tydlacka, President & CEO of iLeaseWorks shares with you the five costly mistakes you should never make when financing equipment.

Key highlights

- Background on Tony Tydlacka & iLeaseWorks

- The true cost of borrowing

- How iLeaseWorks helps doctors to calculate the cost of borrowing

- The cost that is involved in that service

- What is iLeaseWorks’ approach when working with customers?

- Who do they work with?

- What is their end goal?

- How do they look at a deal?

- Unraveling hidden charges

- Evergreen clauses

- Advanced payments

- Simple interest rates

- APR

- Simple interest vs. APR

- Declining principal balance

- Importance of getting an amortization schedule

- Advance payment and what is downpayment?

- How does iLeaseWorks help doctors by reviewing contracts?

- Cost of ownership and cost of borrowing

- Early payouts

- Latest practices in borrowing?

- Payment penalties

Website: www.ileaseworks.com

LinkedIn: www.linkedin.com/in/tydlacka

Telephone: 612 747 7915

Resources

Connect with Us:

Category: Business of Aesthetics Podcast